SEO Strategies For Fintech Service Providers in 2025

Date : January 23, 2025 By

Contents

- 1 Fintech SEO: What Is It? And How Is It Different from Regular SEO?

- 2 Key Challenges of SEO for Fintech Service Providers

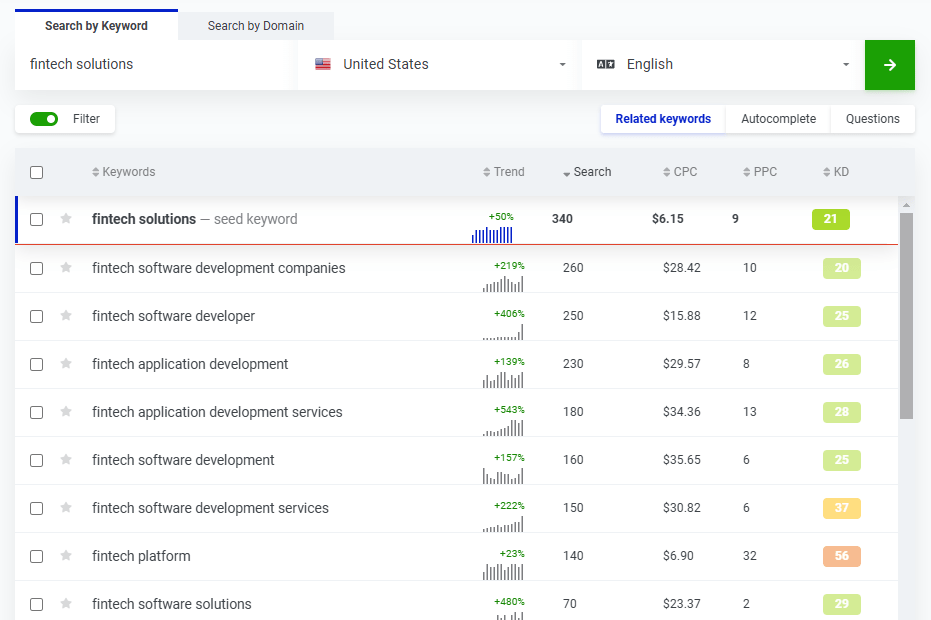

- 3 Keyword Research and How It Factors in to Fintech SEO

- 4 Get to Know What Your Fintech Competitors Are Doing in SEO

- 5 Exploring Fintech’s Technical On-Page SEO

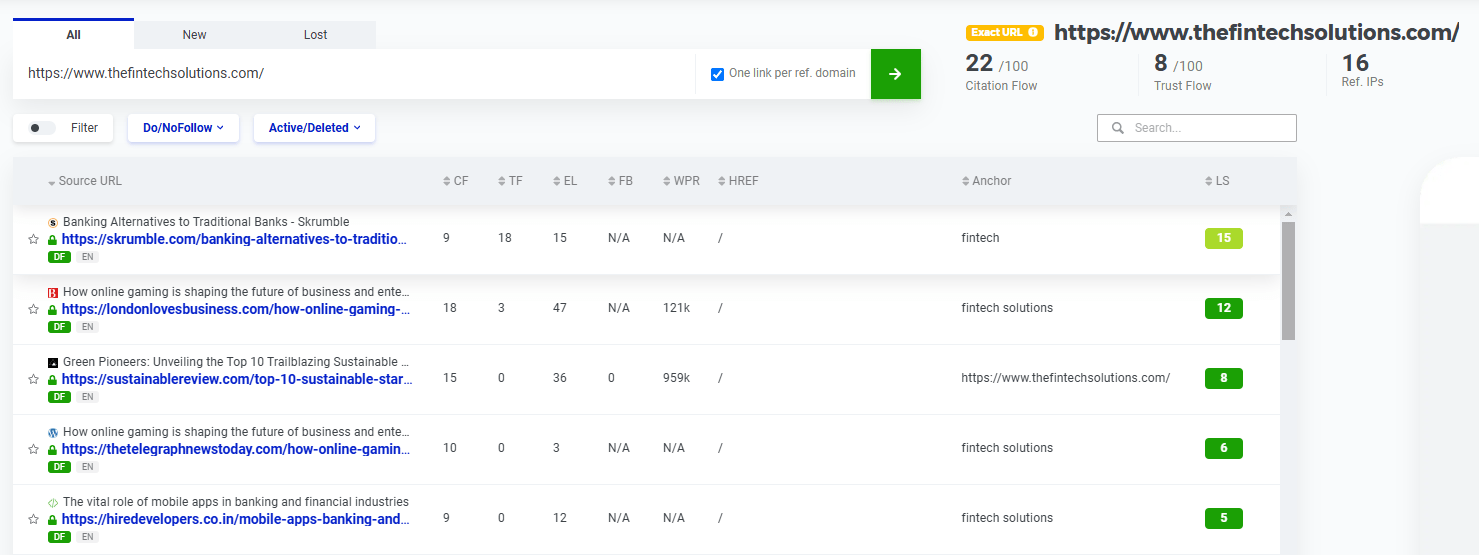

- 6 Fintech Companies and Off-Page SEO

- 7 SEO Content and the Industry of Fintech

- 8 How Do We Measure SEO Success for Fintech Companies?

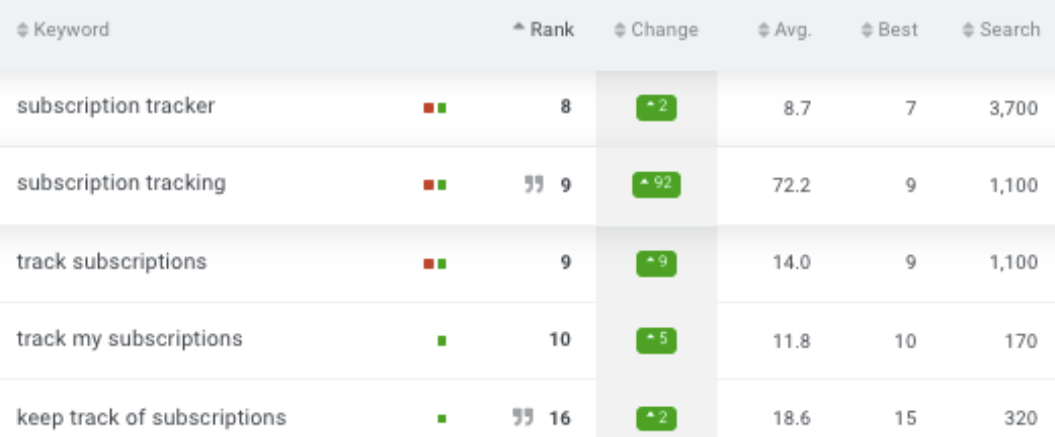

- 9 Fintech SEO Case Study and Testimonial

- 10 Summary: Dominating Fintech SEO in 2025

- 11 FAQ

Today, the fintech sector continues to grow fast with more and more competition in digital banking, payment solutions, and wealth management platforms. Despite this fierce competition, SEO has become a main driver of online visibility and customer acquisition for fintech. This ensures that service providers stand out in this competitive niche.

This article explores must-have SEO practices for the fintech industry in 2025 and strategies that can help boost search rankings, organic traffic, and conversion rates into leads. Additionally, it explains how to build trust in the fintech industry, where credibility is everything.

Fintech SEO: What Is It? And How Is It Different from Regular SEO?

Fintech SEO is finance-specific and can deal with challenges that general SEO can’t. According to Google Helpful Content policy, fintech is a “Your Money or Your Life” (YMYL) niche. Basically, we’re dealing with topics that could have affect society’s health, financial stability, safety, or well-being. YMYL websites’ content needs to possess significant experience, expertise, authoritativeness and trustworthiness (E-E-A-T) to receive more weight in ranking systems of Google.

In addition, when planning SEO for fintech, managers need to take into account regulatory compliance. Compliance requirements from the SEC and FCA in the US and UK restrict certain types of content that could be used. You absolutely have to watch out for keywords like “guaranteed returns” or “risk-free investment” because you don’t want to mislead users. This is a big reason that SEO managers can’t just target high-traffic terms like “best risk-free investment.” Instead, they should focus on compliant and educational content (i.e., “understanding low-risk investments” or “how to assess investment risk”).

Why Do Fintech Companies Need SEO?

SEO leads to greater online visibility, improves search rankings, and boosts organic traffic. Companies can then get leads and customers.

What’s more, this method of lead generation is scalable. There are thousands of thematic and indirect keywords that are relevant to fintech audiences. The obvious choice might be something like “best personal loan rates,” “how to apply for a personal loan,” or “personal loan calculator.” A more indirect approach might look like “how to improve your credit score,” “budgeting tips for beginners,” or “ways to save for a down payment.”

Compared to paid advertising, SEO saves money by building long-term organic traffic. Even better is the fact that SEO traffic can have a potentially higher conversion rate because it focuses on niche keywords. All around, it creates valuable content.

Fintech is truly cutthroat, with startups fighting against established institutions. Without a strong SEO presence, even the best may go unnoticed and lose trust. For fintech, SEO goes beyond improving rankings— it establishes authority in a field where credibility is a deciding factor for a potential customer. Appearing in the top search results for queries like “safe online loans” or “top investment platforms” is exactly what you want here.

What Does Effective SEO Look Like in Fintech?

An effective fintech SEO strategy starts with in-depth keyword research. Keywords should line up with user intent, whether they’re searching for info on how to solve their financial problem, comparing fintech service options, or ready to purchase a specific product.

Technical on-page SEO is equally important. It lets bots easily crawl and index content, creates secure website architecture, speeds up loading, ups mobile responsiveness, and uses structured data for the representation in SERPs.

Content plays the most important role in fintech SEO. Content offers useful info through blogs, guides, and case studies that address customer pain points. Of course, the content needs to align with E-E-A-T principles, and its metadata should be optimized.

Click-through rates in SERPs, bounce rates, and other user engagement metrics are important, too. They play a big role in improving fintech SEO performance. Search engines analyze these clickstream behaviors to figure out how relevant your site is, as well as its content quality.

Lastly, off-page SEO should be considered. This kind ups your website authority through link building, unlinked mentions in press releases, social signals, directory listings, and other methods. Obviously, your website needs to be mentioned on relevant, reputable financial websites that similarly ensure compliance with Google’s E-E-A-T.

Key Challenges of SEO for Fintech Service Providers

So, we already mentioned regulatory compliance and Google’s YMYL policies for fintech. Here are some other issues you may run into due to fintech’s competitive nature, technical intricacies, and diverse audiences.

Keyword Difficulty

Because of the competition in fintech, many companies will try to rank for the same high-value keywords. Terms like “best mobile banking apps” or “how to invest in crypto” are coveted. The SERPs for these are often dominated by large players with high website authority.

For example, a fintech startup offering a cryptocurrency trading platform might struggle to rank for a high-value keyword like “how to invest in crypto.” This is because the SERPs are dominated by Coinbase, Binance, or financial publications like Forbes and Investopedia. The same can be said for keywords like “best budgeting apps,” where competitors include Mint, YNAB, and NerdWallet.

As you can see, ranking for such keywords quickly becomes overwhelming for smaller, emerging companies. One solution is to seek out less competitive, long-tail keywords and niche-specific terms. These options will still attract relevant traffic while being less saturated.

In the above examples, consider these keywords: “crypto investment tips for beginners,” “how to start investing in altcoin,” “how to create a family budget using apps,” or “budgeting tools for freelancers”. This strategy helps you to pull a niche audience and grow your authority over time while avoiding direct competition with major players.

Complexities of Local SEO

Many fintech services cater to localized markets. It’s common amidst regulatory constraints and specific regional demands. Optimizing for local SEO means that you have to handle localized keywords, support specific technical requirements like hreflang tags, create region-specific landing pages, and manage consistent business listings. Where it gets difficult:

- performing the right multilingual keyword research;

- adequately technically optimizing multilingual website structure;

- translating and localizing the content, while complying with legal rules;

- avoiding duplicate content issues.

A Subpar Page Load Speed

Page load speed can make or break user experience and SEO. A lot of times, fintech platforms are packed with high-res visuals, charts, or data-heavy features. They then face challenges in optimizing for performance.

Slow load times could up your bounce rates and lower your place in rankings. What’s more, fixing this is not a one-time task. It requires continuous monitoring, especially as new features, updates, and content are added to the platform. This often demands great teamwork among marketers, developers, and IT specialists so companies can meet both user expectations and technical SEO requirements.

Keeping Content Up-to-Date

Google explicitly recommends keeping website content fresh because the landscape changes constantly. Outdated content with mistakes can harm a company’s credibility and SEO performance (especially in the YMYL niche). Your team might use a lot of resources on content updates. Regular audits and agile content production will help you stay ahead.

Keyword Research and How It Factors in to Fintech SEO

Who Does the Actual Research?

SEO specialists, digital marketing agencies, and in-house marketing teams are common choices. They use tools like Ahrefs and SEMrush. Along with their expertise, they find and prioritize relevant keywords based on volume, keyword difficulty, and potential conversion rates. It’s also common to see them collaborate with company sales teams to ensure client happiness. Domains of interest include:

Keywords Relating to Financial Products and Services

These are more broad, like “best savings account,” “crypto investment platforms,” or “personal finance tools.” They have high traffic, but with that comes high keyword difficulty if other sites have more authority.

Local Keywords

An example here would be “cryptocurrency exchanges in Dubai” or “mortgage refinancing in Sydney.” They boost relevance for geographically specific searches and are usually easier to seek out. It’s even better if your site specializes in local content.

Niche Expertise Keywords

Keywords that reflect a specialization – “blockchain-based lending platforms” or “AI-powered investment tools” – establish authority and draw in niche audiences.

Technology-Based Keywords

In tech, you’ll see keywords like “open banking APIs,” “blockchain integration in finance,” and “AI in insurance.” They’re really appealing to tech-savvy fintech users.

Keywords Relating to Financial Struggles

These keywords target users’ problems that need solving. For example – “how to manage student debt” or “strategies to reduce tax liability.”

Information-Based Keywords

These queries – “what is decentralized finance?” or “how does P2P lending work?” – attract users who want educational content. What’s more, these keywords build trust and awareness.

Regarded Fintech Keywords

You’re going to see terms like “robo-advisors,” “AML compliance tools,” and “fintech regulatory updates.” They’re bread and butter in this industry.

It’s important to leverage these diverse keyword types so that your company can create a well-rounded SEO for all stages of user intent.

Get to Know What Your Fintech Competitors Are Doing in SEO

Competitive analysis is a critical component of any SEO strategy and fintech is not an exception. Understanding your competition reveals what works for them and also helps find growth points for your existing fintech project.

Step 1 – Finding Your Competitors

The first step is to figure out who your actual competitors are. Businesses that provide similar financial products or services, share the same target customer, or compete with you for the same spot on SERPs are likely to be those. Use tools such as SEMrush, Ahref,s or others to identify who wins the ranking for your target keywords & has the majority of visibility on similar searches. Identify high-performance keywords that are included in your offerings target, and identify opportunities you can capitalize on ahead of your competitors.

Step 2 – Checking Competitor Websites

I often start by looking at their website structure to understand the user experience. I look at categories, subcategories, and landing pages. Next, I consider:

- Google PageSpeed Insights or GTmetrix (for page load speed);

- Google’s Mobile-Friendly Test (for mobile responsiveness);

- Google Rich Search Results Test (for viewing structure).

Next there’s on-page SEO:

- Meta titles and descriptions – are they optimized for keywords?

- Internal links – are they useful for navigating the site?

- Hierarchical navigation – do they include breadcrumbs?

Step 3 – Learning from Content

Examine the type, size, quality, authorship, frequency, and indexing status of your competitors’ content. Are they producing blogs, case studies, or whitepapers? What’s their average word count and depth of analysis? Who writes their content? How much expertise do they have for a YMYL website? Are they using text-only content or also adding images/videos? How often do they make new posts? Is it all indexed in Google? What about Bing? What’s the visitor data from Semrush or SimilarWeb for each piece you like?

Step 4 – Analyzing Backlinks

You can use tools like Ahrefs, Moz, or SEMrush to analyze your competitors’ backlink profiles. They locate the high-authority domains that link to them and the type of content that attracts them. Pay attention to patterns – such as whether they gain links through guest posts, partnerships, or news mentions. Then, take a closer look at the quality and quantity of their backlinks.

From here, I suggest that you try to match or even go beyond their linkbuilding efforts. Keep an eye out for reputable sites (i.e., financial news outlets, blogs, or forums). Then, you can make high-value, link-worthy content like whitepapers, original research, or expert guides. Additionally, it’s wise to begin relationships with industry influencers or to use PR strategies and get high-authority links.

Exploring Fintech’s Technical On-Page SEO

On-page SEO means basically that you’re technically optimized for search engines. Thus, it’s easier for bots to crawl, understand, and index site content. I’m going to run through some of the most important parts of on-page SEO. This includes typical tech issues and problem-solving tips for fintech sites.

First, Look at Your Website Structure

You want a thorough, hierarchical site. Users will have a better experience, and search engine visibility will improve. I recommend being logical and organizing by service category, for example, “Loans”, “Investments”, and “Payment Solutions”. Implement breadcrumb navigation (e.g., Home > Services > Loans) and consistent URL patterns (https://fintechsite.com/services/loans). These methods help users and search engines easily understand the content hierarchy. In turn, you get better crawlability and SEO performance.

Second, Consider the 301 Redirection

301 redirections must be configured properly between the www and non-www versions. You need this between http and https, too. Let’s say that http://fintechsite.com is accessed. It should send users to the secure version (https://www.fintechsite.com). Search engines can then index the correct version. You’ll also align the sitemap.xml with the canonical URL structure for optimal SEO.

Third, Find Mixed HTTP and HTTPS Resources

HTTP resources in this case are images, scripts, or CSS files that load on secure HTTPS pages. My advice is to spot and fix these ASAP, because it might set off browser warnings about “mixed content.” Avoid this so you don’t lose trust or security. For instance, a secure page — https://fintechsite.com/investment-plans — has an image with an HTTP URL (http://fintechsite.com/assets/chart.png), and this produces such an optimization issue.

Fourth, Pay Attention to Canonicalization & GET Parameters in URLs

You’ll also need canonical tags to manage duplicate content. Think about loan or mortgage calculators with dynamic inputs (e.g., https://fintechsite.com/loan-calculator?amount=10000&duration=12). The canonicals for these should point to the main calculator page (https://fintechsite.com/loan-calculator).

Also, product filtering pages for services like credit cards (e.g., https://fintechsite.com/credit-cards?reward=travel) should have a canonical URL that consolidates everything to the main product page (https://fintechsite.com/credit-cards). And for multi-language or multi-currency pages (e.g., https://fintechsite.com/pricing?currency=USD), the canonical URL should lead to the primary pricing page (https://fintechsite.com/pricing).

Core Web Vitals

You want the best possible loading speed, interactivity, and visual stability so you can meet Google’s Core Web Vitals standards and user expectations. Consider this for loan applications and payment portals as they’re usually resource-heavy. One way around this is to compress large assets, minimize JavaScript execution, and use a Content Delivery Network (CDN). Interactive elements need to respond fast. And, of course, you can avoid layout shifts by setting explicit dimensions for images.

Mobile-First Indexing

Let’s face it – we live in a world where you can pay for things, invest, and manage bank accounts on your phone. Because of this, you absolutely must have fast-loading pages, touch-friendly navigation, and fonts that you can read. Also, Google now indexes your pages preferably in their mobile look. People should be able to use loan calculators and payment buttons without having to zoom or scroll. Users can be turned away faster than you’d know if they can’t get to what they need without opening up a laptop. Test out these features on different devices and browsers to make sure you’re up to snuff.

XML Sitemap & Robots.txt

So, if you aren’t making, updating, and submitting XML sitemaps in Google Search Console, you should really start. This way, search engines can index key pages. And make sure you’re carefully reviewing and setting up the robots.txt file to block sensitive or irrelevant pages without losing accessibility. There are some more sensitive parts of fintech websites – like admin panels. These should be blocked for indexing. You don’t want to have things like that exposed in search results and run into security risks. The same really goes for user-specific dashboards, login areas, and internal testing/staging pages. The last thing you want is to have private or non-production content indexed, trust me.

Using HTTPS

You’re going to deal with a lot of sensitive user data in the fintech field. It’s just the way things are. That’s where HTTPS comes into play. You need this if you want secure use of SSL certificates. Make a habit of checking in on SSL certificates, and make sure they’re valid and fresh. Browser warnings are great at scaring away users. And remember – HTTPS is a ranking signal for search engines, so you’ll need it for user security and SEO performance.

Duplicated/Missing Meta Tags & Headings Optimization

Every web page needs unique, keyword-rich meta tags. What’s more, tags should clearly convey the page’s purpose. Don’t use “Our Services,” for example. That’s too generic. Instead, try “Investment Services – Secure Your Future with Fintech Solutions.” Otherwise, you might face meta tag duplication or loss. It could dilute your ranking potential, and you don’t want that. Lastly, make sure to have a clear subheading structure (H1, H2, H3) on your pages.

Structured Data Markup

This is important when it comes to improving how your fintech website looks in search. Good schemas provide quick, relevant info that users can trust. Some schemas to keep in mind in the fintech niche:

Financial Services

When should you use the Service schema? It’s good for highlighting key offerings (i.e. loan calculators, digital wallets, or investment management tools).

Customer Reviews and Ratings

Use the AggregateRating schema to show off the overall ratings and reviews for specific services (i.e., loan applications or payment platforms).

Products

You can use Product schema to show details about credit cards, loans, or investment packages. Pro tip: make sure to include pricing, features, availability, etc.

Articles and Blogs

The Article or BlogPosting schema optimizes educational content and insights.

Organization and Contact Information

Use the Organization and ContactPoint schemas to share customer support info, office locations, and business hours.

If you use them right, these schemas can make your fintech site look better, get you better click-through rates, and build a more engaging user experience in search results.

Fintech Companies and Off-Page SEO

If you’re not familiar, off-page SEO is pretty much exactly what it sounds like. It involves actions taken outside the website (linkbuilding, social media signals, brand mentions and others). When you do it well, you can appear more credible to search engines.

Backlinks – A Way to Gain Authority

External websites can “backlink” to your website. This just means that they make links that redirect back to your site. It’s a way of saying that your site is credible and valuable. These are a must, and you want to get them from authoritative domains in finance, tech, or related industries.

You’ve got to think in terms of quality over quantity here, too. It only takes one link from a big financial publication or trusted industry blog to make a difference. Spammy or irrelevant links can even damage your SEO efforts and brand.

I think the sweet spot is to get backlinks from sites with a Domain Authority (DA) score >50 and a Trust Flow (TF) score >25. I get these numbers based on parameters measured by Moz and Majestic. And they’re great at telling you whether a site is trustworthy or has a high quality. Below, I’ll outline some ways to get them.

Press Releases

Make an effort to make quality press releases for new products, partnerships, or achievements. You could get covered by reputable fintech-focused news outlets. It leads to solid backlinks and more visibility.

My recommendations are Finextra, The Paypers, or Payments Journal, as well as major financial institutions and tech providers. You’ll even gain traction on sites like Crowdfund Insider or Fintech Futures.

And don’t forget Business Wire (Financial Services) and GlobeNewswire. Whether that includes investors, financial professionals, or tech enthusiasts, you’ll be set.

Over time, you’ll see more traffic to your site and more brand mentions. This is true even if they’re unlinked, which still helps your SEO results.

How to Get Started with Guest Posts

The next topic I want you to consider is guest posting. You’ll basically find some strong-authority blogs or websites that are relevant to you and the industry. Then, you’ll make a smart and insightful post on one of those sites. If you can manage this, you’ll see some growth and maybe even get some backlinks out of it. When people ask me which opportunities I recommend, I usually mention these:

- PRNews.io – For spreading content, good for finding guest post opportunities on reputable sites.

- Authority Builders – For connecting with high-quality sites where you can guest post in your specialty.

- Finextra – For news about banking and fintech, good for contributing thought leadership.

- The Fintech Times – Global, news-heavy, and full of insights. Great for guest contributors who can share knowledge.

- PaymentsJournal – Fintech-focused, good for expert content on payment tech and financial services.

Influencers

Collaborate, collaborate, collaborate! This is advice you should heed if you want exposure or backlinks. It’s important to note which highly followed accounts share an audience (or potential audience) with you. They could be the ones to launch your growth by reviewing or writing a guide to one of your products.

Directories

Directory listings – they’re a simple yet effective way to up visibility and get those backlinks. Try these out:

Getting Off-Page and into the Social Sphere

I just have a couple of things to say, as this advice may seem obvious at this point. But here it is: LinkedIn, Twitter, Instagram, Reddit (subreddits like r/FinTech and r/PersonalFinance). You’ve got to post your reports and successes there to get social mentions.

SEO Content and the Industry of Fintech

Now, I’ll explore which content is best and how you can make it under Google’s YMYL requirements.

Understanding the Audience You’re Targeting

Save yourself the agony of doing this manually, and just opt for a tool like SparkToro. It helps you find the content that your target audience is seeking. Now, let’s talk a bit more about that content and what it entails.

Content

-

Info-Heavy

This type of content – guides, blogs, articles, etc. – can tackle FAQs and offer solutions.

-

Stories Highlighting Success & Case Studies

Don’t forget to mention your success, like that one time that you cut costs for a retailer last year! Potential clients will be hooked. The ideal case study should include the client’s problem, your solution, and measurable outcomes (cost savings or increased efficiency).

-

Whitepapers & Industry Reports on Trends

Okay, I’m going to get a bit more technical here. When we talk about this content, we’re talking about highly researched stuff. They’re about trends, tech, and regulations in the world of finance. The bonus? This is a great way to get new leads.

-

Fresh Content & E-E-A-T Guidelines

If your content isn’t super helpful and super up-to-date, I’m afraid that it’s no good. Users will rely on your brand’s knowledge to make important financial decisions. And you wouldn’t want to betray them with misleading info, right? Keep in mind what people want to know – new info about interest rates, compliance, and product features. You’ll want to try and refresh pages and posts every 3-6 months.

-

Google Content Raters Guidelines & YMYL Content

As I mentioned already, much of the fintech content falls under Google’s YMYL category. This includes any info that can impact a user’s financial well-being, safety, or trust. As such, fintech content must meet the highest standards of quality, accuracy, and trustworthiness to satisfy both users and Google’s content raters.

Luckily, pros in the fintech world these days can easily access Google’s guidelines. Google lays things out in detail here: Search Quality Evaluator Guidelines. It’s a resource that human evaluators use to understand the level of expertise, trustworthiness, and user satisfaction for content.

Here’s an easier way to keep these guidelines in mind: E-E-A-T (Experience, Expertise, Authority, and Trustworthiness). It starts with accurate and well-researched info. And, it’s got to be written by an expert (or at least attributed to one). For example, if you’re going to post a blog on investment strategies, it must credit sources, sound clear and professional, and be written by an investment pro.

And don’t forget to stay transparent. Pages about financial products or services should have disclaimers and T&Cs so you don’t mislead users.

How Is AI Changing Fintech Content?

AI – LLMs in particular – has become a powerful tool for creating fintech content at scale. However, we need to carefully combine automation and human expertise to meet industry requirements.

AI tools like ChatGPT, Jasper, and Claude can spit out informational content. If you want a guide on personal finance or FAQs about your platform, they can do just that. These tools review data trends to create reports and can think of user questions before they’re asked. The result is that you can better align your content with your audience. AI also makes dynamic content, like personalized loan recommendations or auto-responses for customer support.

However, there’s something to keep in mind. AI is fine for a draft, but it needs human eyes on it at the end of the day. Check for accuracy, compliance, and authoritative sources. You also need to check for disclaimers to stay transparent.

How Do We Measure SEO Success for Fintech Companies?

You can use certain metrics that align with your business goals to measure success. Here are 3 metrics I like to report to clients.

Organic Traffic (Non-Branded)

This data shows you how well your website is attracting users through search engines. Here’s where you need to grow if you want to be successful. Make sure not to count branded keywords, as they don’t indicate SEO performance, just your brand knowledge.

Keyword Ranking Data

Keep an eye on your keyword rankings. This will help you target the right audience with your content. Higher rankings for strategic keywords directly translate into increased visibility and traffic. Make sure to track rankings in the target geographical regions of your project and also compare rankings on desktop and mobile devices. This will show you where you can improve.

Conversions & Conversion Rate

Conversion rate measures how effectively your website turns organic visitors into customers. An optimized SEO strategy should lead to higher conversions by attracting qualified leads.

Google Analytics lets you track conversions, as well as the conversion rate, by breaking down traffic sources. Make sure your SEO traffic is converting into leads, and take SEO-relevant CRO actions if it doesn’t.

Fintech SEO Case Study and Testimonial

One of my success stories involves a Fintech SaaS company that began as a dedicated server provider and later expanded to offer premium CDN solutions on a reselling basis. Based on customer feedback about difficulties in managing subscriptions, the company developed a financial subscriptions tracker as a spinoff.

At first, the project struggled to rank for competitive keywords like “subscription tracker” and “track subscriptions” in the US. This was mainly due to limitations of the landing page builder used for their website.

So, the decision was made to overhaul the website platform entirely. I was tasked with technical optimization of the new pages, creating new content for the blog and help sections, and conducting off-page link building. Over an 8-month period, which included three months for platform replacement, significant improvements were made in the US Google search rankings:

- “Subscription tracker” reached 8th place

- “Subscription tracking” achieved 9th place

- “Track subscriptions” climbed to 9th place

Summary: Dominating Fintech SEO in 2025

To thrive in the competitive fintech landscape, you must master SEO to gain visibility, trust, and growth. I often tell site owners that they must address YMYL requirements. So, optimize technical aspects, create authoritative content, and stay up-to-date with E-E-A-T principles.

You should also build high-quality backlinks by guest posting, doing press releases, and collaborating with influencers. You want to stay active in algorithm updates and tracking metrics (organic traffic and conversions). If you combine these strategies, you can build a strong foundation for sustained success in 2025 and beyond.

FAQ

So, how long will it take to see results with fintech SEO?

This could vary depending on competition, the effectiveness of your strategy, and how well your website is already optimized. It usually takes 3-6 months to start noticing increased rankings, organic traffic, and conversions. But SEO is a long-term investment, and you need to continue monitoring and optimizing to build on your results.

Where do you find high-quality copywriters who have fintech experience?

In order to make accurate and engaging content, you need expert copywriters. Platforms like LinkedIn and Upwork connect you with pros who have proven expertise in financial and technical writing.

How much do fintech SEO services cost?

It will vary a lot depending on the scope, goals, and level of competition in your industry. The average small or mid-sized SEO package is $1,000-$5,000/month. Larger and more competitive ones are $10,000+/month. This is because of more complex YMYL requirements, regulatory compliance, and the need for high-quality content and link building.